When it’s time to hit the road with your new ride, one of the most significant investments you’ll make is in auto insurance. It’s not just about fulfilling legal requirements; it’s about protecting your hard-earned assets. But when every penny counts – which is precisely the case for many new drivers or those tightening their belts – the search for an affordable auto insurance policy becomes as crucial as securing the vehicle itself.

However, in the labyrinth of insurance providers, it can be overwhelming to find the right balance between cost and coverage. But fear not – this guide navigates through the intricacies of auto insurance, arming you with the knowledge to pinpoint the cheapest options without compromising on protection.

Understand What Determines Your Auto Insurance Cost

Before we scout for savings, it’s essential to familiarize ourselves with the variables insurers use to calculate premiums. Several key factors often influence the cost of auto insurance, including:

- Your driving record: This is probably the single most influential factor – a scarred record typically equals higher premiums.

- The vehicle you drive: New, flashy, or powerful cars come with higher insurance tags.

- Your personal profile: Age, gender, marital status, and even your credit score all play a role.

- Location: Your ZIP code can significantly impact your premiums due to the crime rate, traffic density, and even the prevalence of natural disasters.

Cheapest Isn’t Always Best – the Importance of Considering Coverage

While the headline cost is an important factor, it’s crucial not to fall into the trap of underinsuring yourself. The cheapest policy might not cover you sufficiently in an accident, which could result in significant financial burdens. Consider the following types of coverage:

- Liability Coverage: Protects you from costs associated with others’ injuries or damages if you’re at fault in an accident.

- Collision Coverage: Pays for damage to your own vehicle if you’re in a collision with another car or a stationary object.

- Comprehensive Coverage: Covers your vehicle from damage caused by events like theft, vandalism, and natural disasters.

Balancing the cost of your premium with the benefits of coverage is the gold standard for any auto insurance pursuit.

Pro Tips for Securing the Cheapest Auto Insurance

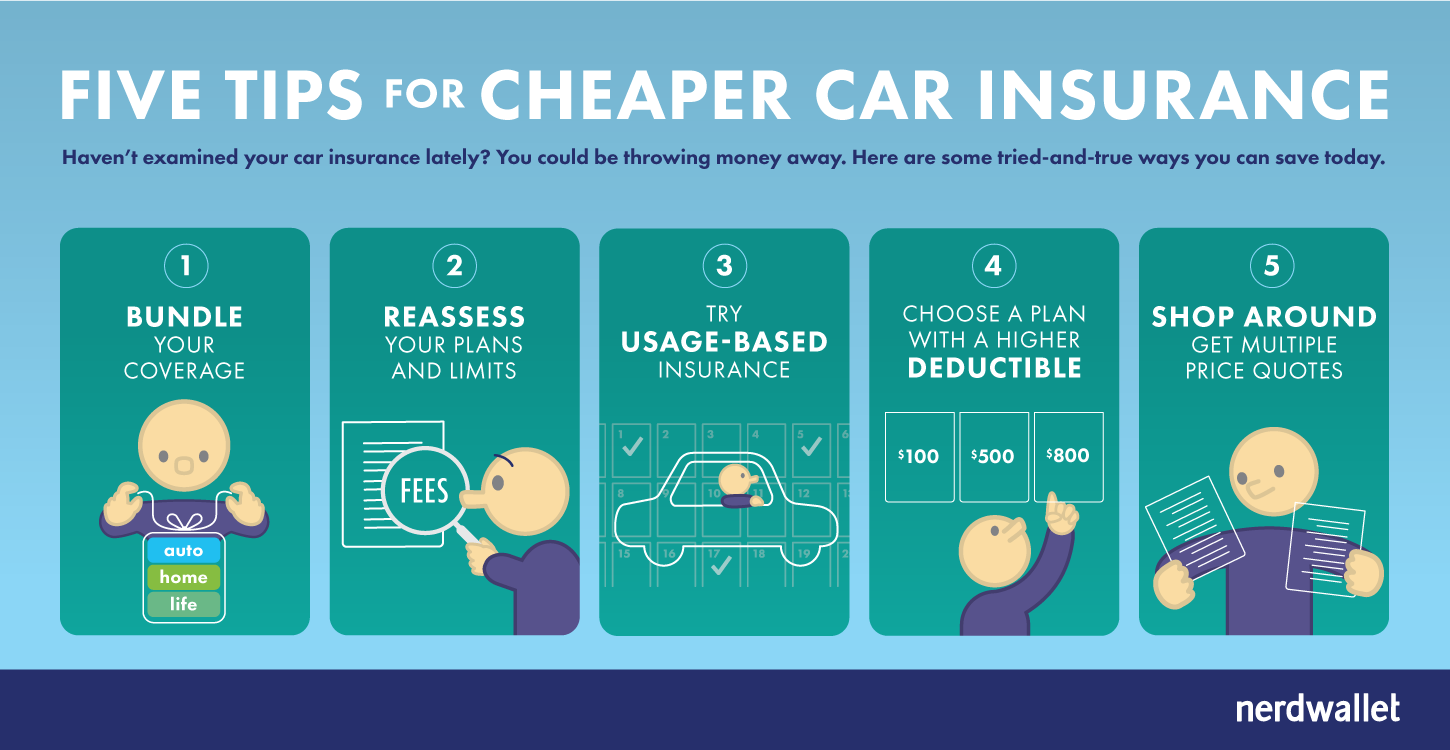

Now we come to the part where we roll up our sleeves and get to the real business of saving. Here are some expert tips and tricks that could significantly lower your auto insurance costs:

1. Shop Around

Don’t purchase the first policy you come across. Different providers weigh the risk factors differently, so getting multiple quotes is critical. Use online comparison tools, and don’t be afraid to haggle once you’ve found an attractive offer – providers might match or beat competitive quotes to secure your business.

2. Consider Higher Deductibles

A higher deductible means lower premiums. However, ensure you can afford the deductible out-of-pocket if you need to make a claim. Savings here could balance out over time, especially if you’re a safe driver with a low risk of accidents.

3. Look for Discounts

Insurers offer various discounts that could apply to you. From bundling your home and car insurance to maintaining good grades (for the young scholars out there), these can add up to some significant savings.

4. Drive Sensibly and Safely

Your driving behavior impacts your costs. Speeding tickets and accidents can send premiums skyrocketing, so maintain a clean driving record to keep your insurance bill in check.

5. Opt for Usage-Based Insurance

Usage-based insurance uses telematics to monitor your driving and can lead to lower premiums if you’re behind the wheel responsibly. This modern approach could be cheaper than traditional plans for many drivers.

Revealing the Best States for Affordable Auto Insurance

Statistics show that the cost of auto insurance varies widely by state. For those eagerly awaiting a glimpse of the ‘cheapest’ possible insurance, these states have historically lower-than-average premiums:

- Vermont: Known for its sweeping natural beauty and brisk winters, Vermont typically boasts some of the nation’s most affordable auto insurance.

- Ohio: The Buckeye State is not only home to great football, but also to some of the lowest car insurance rates in the country.

- Idaho: With its wide-open spaces, Idaho has relatively few drivers, which helps keep car insurance costs down.

Final Thoughts – Saving Grace or Hidden Costs?

While finding the cheapest auto insurance is a triumph for any budget-conscious driver, it’s essential to approach the process with a balanced perspective. Cheaper isn’t always better if it leaves you inadequately covered. Decide on your budget, know your needs, and use these insights to secure the best deal that gives you the peace of mind you need on the open road.

For those still feeling lost in their quest for budget-friendly auto coverage, remember that diligence in research and a smart approach to policy selection can lead to savings that make a real difference in your monthly expenses. It’s a step-by-step process that, with each informed decision, brings you closer to the cherished finish line of affordable protection.

With your car running smoothly and your wallet breathing a tad bit easier, the road ahead will seem all the more inviting. Just ensure that your drive, no matter how cost-effective, doesn’t veer into the lanes of inadequate coverage. Happy and safe driving!