For every 20-something driver out there, the milestone of turning 25 not only rings in a significant birthday but is also often associated with a substantial decrease in car insurance rates. Whether through overheard conversations or personal anecdote, the belief is entrenched — “Car insurance drops dramatically at 25.” However, the mechanics that dictate car insurance premiums are more complex than a simple age cut-off. In this comprehensive guide, we’ll explore the factors that can impact car insurance rates for the under-25 demographic and discuss what changes, if any, can be expected after hitting the quarter-century mark.

The Science of Car Insurance Premiums

Auto insurance companies utilize a sophisticated system of actuarial science to determine the risk profile of their insured drivers. This risk assessment is primarily based on a combination of personal and vehicle-related factors, with age being a significant component.

Risk and Reward at Every Milestone

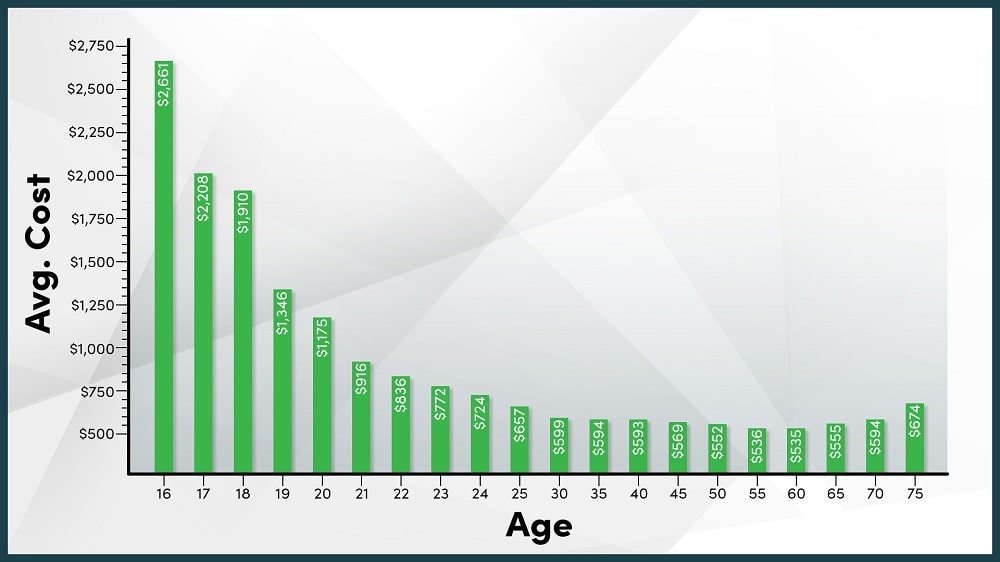

The first few years of driving are often the riskiest, which somewhat explains the commonly perceived premium ‘penalty’ for young drivers. To the insurance industry, you are a part of a demographic with a statistically higher likelihood of being involved in an accident. Thus, until the mid-twenties, it’s a matter of balancing risk and reward. By 25, insurance companies anticipate that the average driver has had more time to accrue experience, which could, in theory, lead to safer driving habits and fewer accidents.

Age Isn’t the Only Number That Matters

While turning 25 might correlate with a decrease in car insurance rates, there’s more to the equation. It’s crucial to understand that age is just one element used by insurers. It’s the interplay of multiple variables that ultimately determines what you pay.

Driving Record and Claims History

Reaching 25 does not erase the past. A clean driving record and a history free from at-fault accidents or traffic violations can offset high-risk age factors, even before the presumed rate drop. Conversely, a poor history could mean that you’ll still be paying higher premiums well past 25.

Credit Score and Financial Stability

Insurance companies often use credit-based insurance scores to predict the likelihood of a policyholder filing a claim. While the relationship between credit scores and insurance premiums varies by state, maintaining good financial standing could significantly impact your rates, regardless of age.

Type of Vehicle and Usage

The car you drive and how you use it affect your premiums. High-performance vehicles, those prone to theft, or employed for business purposes can result in higher insurance costs. Similarly, where you live can entail different state minimum insurance requirements and impact rates.

An Overlooked Secret to Saving on Insurance

Graduating college, starting a career, or even getting married around the same time as turning 25 could indirectly contribute to lowering car insurance rates. How? Each of these life events can prompt adjustments to your coverage and policies that a more experienced driver is likely to explore, potentially leading to savings.

Bundling and Multi-Policy Discounts

Marriage is cross-referenced with a reduced likelihood of risky behavior and could mean lower rates due to a multi-car or home-and-auto policy bundling. Many insurers offer discounts for maintaining multiple policies with them, a fact often leveraged by older, financially-savvy policyholders.

Occupation and Education

A change in career or educational status might not directly influence rates, but they could provide opportunities for group or professional discounts. Some companies offer lower rates to individuals who are part of certain professional organizations or who have completed accredited driving courses, which may become more relevant in the professional realm after the age of 25.

Navigating the Transition to Lower Premiums

Transitioning from the ‘youthful driver’ age bracket might naturally coincide with an interest in understanding insurance better and seeking ways to take control of costs. This section will provide practical tips and insights for harnessing the drop in car insurance rates at 25 and setting the stage for a more favorable insurance future.

Reassess Your Coverage Needs

With new freedom and responsibilities comes the necessity to review your coverage. You might need more robust protection if you’re now financially tied to property or there’s a change in your medical insurance situation. Conversely, past policies may now be unnecessarily comprehensive compared to your current lifestyle.

Shop Around for the Best Deal

While turning 25 could initially lower your rates with your current provider, it’s also an ideal time to explore other options. Shopping around for quotes and comparing coverage from different companies can lead to significant savings. Remember that loyalty to one insurer doesn’t always guarantee the best rate.

Consider Higher Deductibles

Increasing your deductibles can be a trade-off for lower monthly premiums. If an accident is less likely given your new refined risk profile, this move could make financial sense and balance out the reduced monthly costs.

The Age-25 Drop: A Real Phenomenon or Mere Folklore?

The question remains — does car insurance magically go down at 25? The short answer is, not magically, but for many policyholders, it does tend to decrease around this age. However, the drop emerges from a combination of factors, not simply the ticking of the birthday clock. Each individual’s circumstances will lead to variations in the scale of reduction.

The Bigger Picture

It’s important to view the reduction in premiums as a piece of the larger insurance puzzle. Age does make a difference, but so do many other variables. The takeaway is that while 25 might not be a magic number, it is a juncture to re-evaluate and optimize your coverage.

In Conclusion

The narrative that car insurance drops significantly at 25 is rooted in some truth, but it is an oversimplification. Lower rates are not a guaranteed gift with no strings attached. Instead, they reflect a maturation process, supported by the choices and actions you make leading up to and beyond this age. For the ambitious 20-somethings who are on the cusp of this milestone, take heart in knowing that your diligence and safe practices can do as much, if not more, to shape your insurance trajectory than the calendar pages flipping by. Remember, it’s not about the reduction, but about the reward for becoming a more knowledgeable, conscientious, and safer driver.