Your car is your ticket to freedom, but the cost of keeping it on the road can sometimes feel like it’s holding you back. Car insurance, an essential expense, is often seen as a grudge purchase – something you need but don’t particularly look forward to buying. However, understanding how to effectively shop for car insurance can save you potentially hundreds of dollars each year. This guide will walk you through the process of obtaining multiple car insurance quotes, demystifying what can be a complex and daunting endeavor.

Why Multiple Quotes Matter

There’s no debating the importance of car insurance – it’s not just peace of mind, but a legal requirement in most places. Yet, with so many insurance companies and policy options available, how do you know if you’re getting the best deal? The simple answer is diligence. By getting quotes from multiple insurers, you increase the chances of finding a policy that fits your needs at a price that doesn’t break the bank.

The Power of Choice

When you get multiple quotes, you’re not just comparing prices – you’re also comparing the value of the coverage and the service you’d receive. This empowers you to make an informed decision based on your unique requirements.

Unearthing Discounts

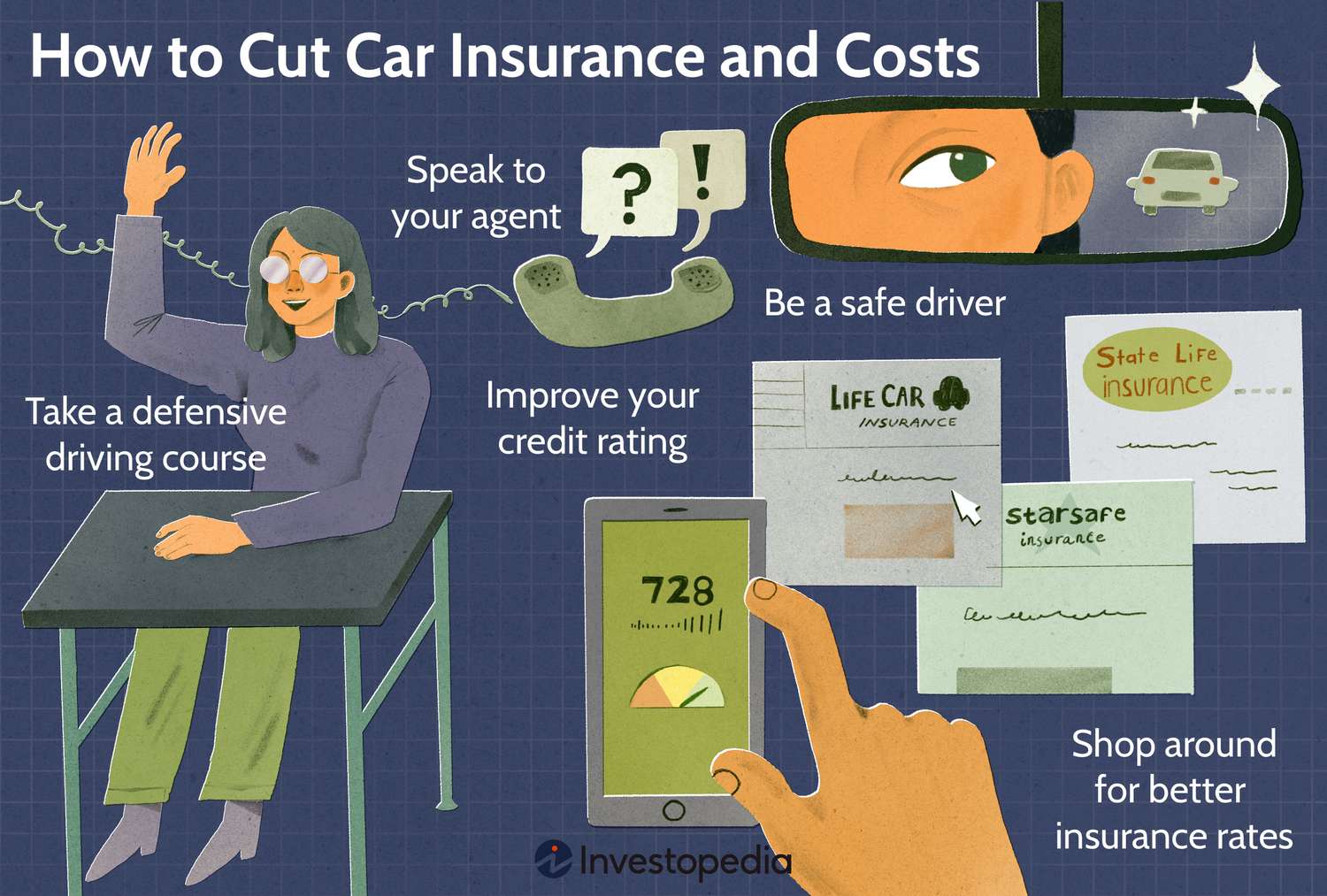

Each insurance company has a multitude of discounts available but may not proactively offer them. By shopping around, you can take advantage of discounts for safe driving, bundling policies, low mileage, and more.

Where to Find Multiple Quotes

With the internet at your fingertips, there are numerous ways to shop for insurance beyond visiting individual insurers or broker offices. The key is to use a variety of sources to ensure you’re casting the net wide enough.

Online Marketplaces and Comparison Websites

These platforms allow you to input your information once and receive quotes from multiple insurers. Be mindful that not all insurance companies are included, so it’s wise to use more than one site.

Directly from Insurers

Some insurers don’t list their quotes on comparison sites, or they may offer lower rates for customers who come to them directly. It’s always worth getting a quote from a ‘direct’ insurer in addition to using comparison sites.

Through an Agent

Independent agents can often get quotes from a variety of companies, giving you access to a range of options in one place. They may also be able to secure discounts not available elsewhere.

What to Consider When Comparing Quotes

It’s not just about the bottom line when comparing car insurance quotes. Here are several factors you should weigh when making your decision.

Policy Coverage and Limits

Make sure you’re not just comparing the price of a policy but also the coverage and limits. Different insurers may include or exclude certain coverage types or offer higher or lower limits on specific items.

Deductibles

The deductible, or the amount you have to pay before your insurance kicks in, can significantly affect your policy cost. A higher deductible usually means a lower premium.

Customer Service and Claims Process

Price isn’t everything. Check out the insurer’s reputation for customer service and their claims process. An inexpensive policy from a company that’s hard to deal with when you need them isn’t a bargain in the long run.

Financial Strength

You’re buying peace of mind, so you need to know your insurer will be there when you need them. Look at A.M. Best or Standard & Poor’s ratings to assess an insurer’s financial stability.

Reviews and Recommendations

Check reviews from other customers and ask friends and family for their recommendations. Personal experiences can give you insights into what it’s actually like to be a customer of a particular insurer.

Maximizing Your Savings with Smart Shopping

Insurance premiums can be lowered through some smart shopping and policy selection:

Choosing the Right Vehicle

The type of car you drive can have a significant impact on your insurance rates. Typically, the more expensive the car, the more it will cost to insure. Similarly, performance cars are more at risk of accidents and theft.

Modifying Your Coverage Needs

If your car is already covered by the manufacturer’s warranty, you may not need certain additional coverage options. Tailoring your policy to your specific situation is an excellent way to cut costs.

Maintaining a Good Credit Score

In some states and with certain insurers, your credit score may affect your premium. A higher score can get you better rates, so keeping your credit in good standing is essential.

Utilizing Technology

Many insurers offer discounts for using technology to monitor your driving habits, such as with telematics and other tracking devices.

The Art of Negotiation

Once you’ve narrowed down your choices, don’t be afraid to negotiate. Often, insurers will match a competitor’s rate to keep your business, or they may be able to find additional discounts that you qualify for.

Bundle Policies

Insuring multiple vehicles or combining your homeowners or renters insurance with your car insurance can lead to significant savings.

Pay in Full

Many insurers offer discounts for paying your premium in one lump sum rather than in monthly installments.

Avoid Lapses in Coverage

Continuous coverage can lead to lower rates. If you have a lapse, particularly a long one, you may be seen as a riskier driver and have to pay more for insurance.

The Final Step: Making the Switch

The final step in the process is to actually switch to the new policy. Before you do, make sure that you’ve:

Confirmed the New Policy Details

Understand exactly what your new policy covers and doesn’t cover. Don’t assume it’s the same as your old policy.

Notified Your Current Insurer

If you decide to switch, make sure to do it properly. Give your existing insurer the correct notice in writing and the new start date of your policy to avoid any penalty.

Double-Checked New Policy’s Effective Date

You don’t want any gaps in coverage, so ensure your new policy starts the day your old one ends. This is typically quite straightforward if you’re changing policies at the end of the term.

Cancelled Your Old Policy (if applicable)

After switching to a new policy, you’ll need to cancel your old one. Again, it’s best to do this in writing and to keep a copy for your records.

In Conclusion

Getting multiple quotes for car insurance is a tried-and-true method of securing the best possible deal. With a comprehensive understanding of the process and these tips, you’re well-equipped to obtain quotes that can translate into real savings. It takes time and effort, but the end result – more money in your pocket and the right insurance for your needs – is undeniably worth it. Don’t settle for the first offer, make the insurance companies work for your business, and enjoy the financial freedom that comes with a well-negotiated car insurance policy.