For many, the excitement of buying their first car is quickly tempered by the looming dread of shelling out for car insurance. In our fast-paced world, where every dollar matters, the quest for affordable car insurance has evolved from a pastime to a necessity. But where does one start in the hunt for reasonable premiums without sacrificing coverage or customer service? If navigating the maze of car insurance is akin to driving in a city you’re unfamiliar with, consider this guide your trusty GPS. Here, we’ll explore strategies that young drivers, frugal consumers, and first-time car owners can employ to secure budget-friendly car insurance.

Understanding the Basics of Car Insurance

Before we set off on our cost-saving adventure, it’s crucial to brush up on the foundational principles of car insurance. Car insurance is essentially a contract between you and an insurance company, with you paying a monthly or annual premium in exchange for financial protection in case of an accident, theft, or other unforeseen circumstances.

Types of Coverage

There’s a buffet of coverage options, from the must-haves to the nice-to-haves. Liability coverage is usually a legal requirement, which pays for the other driver’s expenses if you’re found at fault in an accident. Then there’s collision coverage, which applies to repairs or replacement of your car in a collision. Comprehensive coverage handles non-collision-related incidents like theft, vandalism, and natural disasters. Personal injury protection and uninsured motorist coverage are also available, depending on the insurer and your state laws.

Factors that Affect Premiums

The cost of your insurance depends on a smorgasbord of variables, including your driving record, credit score, age, gender, location, the make and model of your car, and even your profession. Understanding these elements can help you tailor your search for an insurance policy that suits your specific situation.

The Low-Hanging Fruit of Discounts

The insurance industry is ripe with discounts waiting to be plucked like golden apples. Most insurance companies offer a range of discounts geared towards lowering premiums for different groups of people. Some common discounts include:

Good Driver Discount

Maintain a clean driving record, and you could be handsomely rewarded. Many insurers offer considerable discounts to drivers who are accident-free for a certain amount of time.

Multi-Policy Discount

Consolidating different insurance policies, such as renters or home insurance, with one provider can unlock significant savings through a multi-policy discount.

Education and Training Discounts

Showing proof of a good academic record or completing a defensive driving course can earn you substantial discounts, particularly if you’re a young or new driver.

Vehicle Safety Features Discount

Modern safety features like anti-lock brakes, airbags, and anti-theft systems can result in lower premiums by reducing the risk of injury and the likelihood of theft.

Navigating the Vast Landscape of Auto Insurance Companies

Patience is a key virtue in the quest for affordable car insurance, especially when the market is brimming with potential providers. It pays to be thorough:

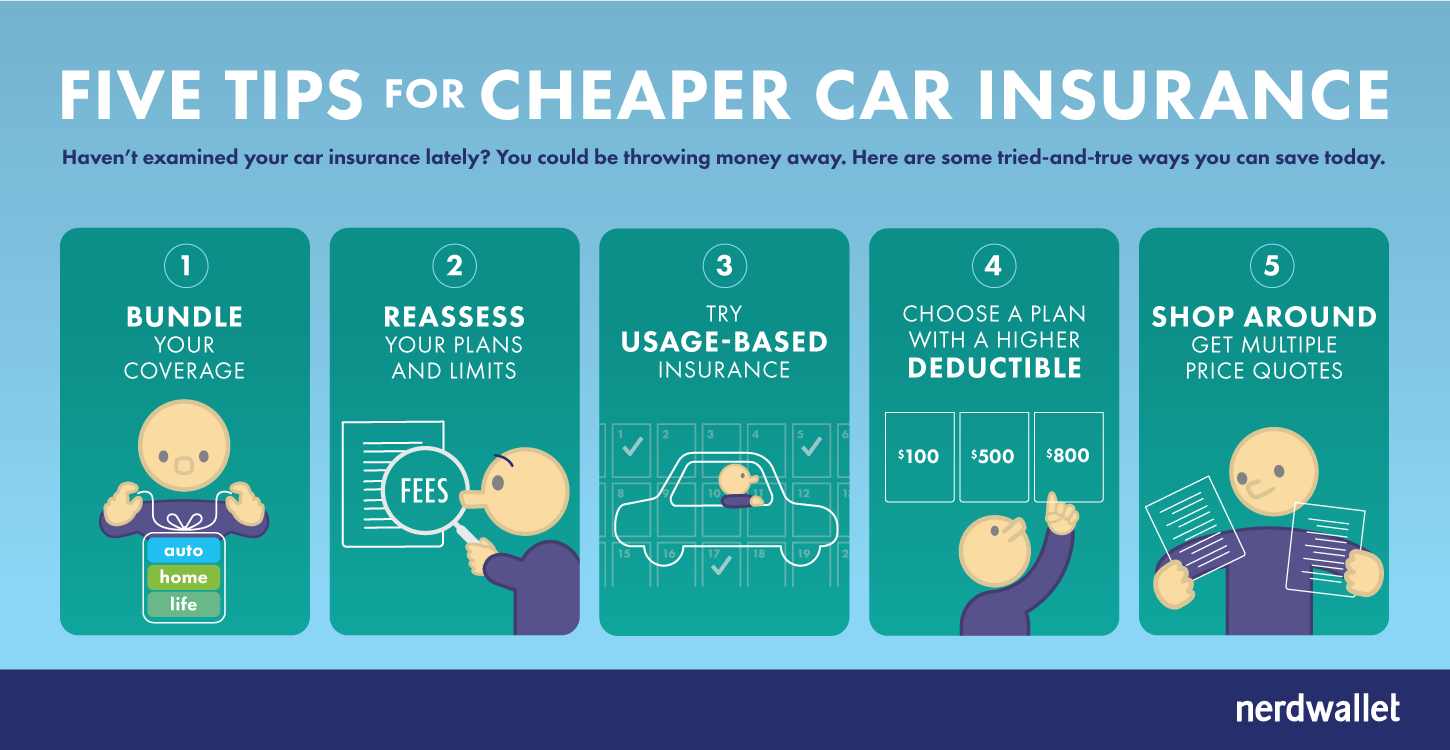

Shop Around

Different companies have different underwriting models which lead to varying premiums for the same level of coverage. Use online comparison tools, but don’t neglect to call local agents who might not be listed online.

Consider Regional Insurers

National brands come with recognition but don’t overlook smaller, regional insurance companies. They may offer more competitive rates due to lower overheads and a focus on localized risk factors.

Know the Geology

Each state has its own insurance regulations, which can influence pricing and what policies are available. Make sure to get quotes tailored to your geographical location.

The Magic in the Math – Tailoring Your Policy to Your Needs

One size does not fit all when it comes to car insurance. A policy that offers every coverage under the sun might sound reassuring but might not be necessary or cost-effective. By taking a few calculations into account, you can customize your policy to your exact requirements:

Deductibles

This is the amount you agree to pay out-of-pocket before your insurance kicks in. Opting for a higher deductible can lower your premiums significantly but leaves you with more immediate costs in case of an accident.

Coverage Limits

You need enough insurance to cover damages but not so much that you’re overpaying. Assess your financial situation to determine the coverage limits that make sense for you.

Staying on Course – Maintaining a Good Driving Record

Long-term strategies can make a world of difference in your insurance costs. Here are a few to consider:

Be Vigilant

One ticket or accident isn’t the end of the world, but a pattern of poor driving can significantly increase your insurance premium. Practice good driving habits to keep your record clean.

Look for Patterns

If your policy seems to be increasing significantly and you haven’t made any claims or got any tickets, it may be wise to shop around. A good driving record should be rewarded with lower premiums.

By the Mile – Exploring Usage-Based Insurance

For those who don’t put in that many miles or have solid driving habits, usage-based insurance (UBI) could be a game-changer. This type of policy bases the cost on the number of miles you drive, the time of day you drive, and your driving behavior, measured using a telematics device or a mobile app.

Maintaining Your Vehicle – The Role of Car Maintenance

Keeping your vehicle in top condition not only saves you money on repairs but also on insurance premiums. Regular maintenance and prompt service for any issues can result in lower insurance costs, as a well-maintained car is less likely to break down or cause an accident.

The Art of the Unseen – Understanding Unseen Costs

There are costs besides the monthly premium that can slip under the radar and affect your overall financial picture. Things like processing fees, late payment fees, and charges for policy cancellations can all bite into the savings you think you’re getting with a cheaper premium.

The Digital Age – Harnessing Technology to Save

In the digital realm, savings abound, and car insurance is no exception. Many insurers offer discounts for signing up or managing your policy online. Additionally, the rise of Insurtech companies has brought forth flexible and often more affordable policy options.

Onward to Savings – Final Words on the Road to Affordable Car Insurance

The search for cheap car insurance is not a sprint but a marathon. It requires a dash of patience, a dollop of research, a pinch of proactivity, and a sprinkle of savvy negotiating. By heeding the advice laid out in this guide, you’ll be well on your way to securing comprehensive yet cost-effective coverage that won’t break the bank.

Remember, while the allure of saving on your premiums is strong, quality should never be compromised. A budget deal is only a good deal if it provides the level of protection you need. Armed with knowledge and sensible practices, you can confidently wade through the sea of quotes, discounts, and policy options to emerge with a car insurance plan that aligns with your financial goals and provides peace of mind. Drive on, Thrifty Ones, and may the road ahead be lined with savings!