For many, a vehicle is more than just a mode of transportation; it’s an extension of independence, a means of exploration, and sometimes, even a passion. However, accompanying the thrill of the road comes the imperative need for security – the kind that can only be found in a robust car insurance policy. But how much should this peace of mind cost you?

In a world of fine prints and wandering asterisks, understanding the true financial investment of full coverage car insurance is crucial. Whether you’re a seasoned driver considering a switch, a new driver grasping the ropes of adulting, or just an individual on the hunt for a better deal, this blog post will serve as your comprehensive guide to demystifying the costs of full coverage car insurance.

Read more: https://nicecar.codepel.com/the-top-5-auto-insurance-companies-in-2024/

What is Full Coverage Car Insurance, and Why Do You Need It?

Before we jump on dissecting costs, let’s establish a fundamental understanding of what full coverage car insurance actually entails. Contrary to popular belief, “full coverage” isn’t a one-size-fits-all term; it’s a combination of several types of insurance coverage bundled into one. A typical full coverage insurance package includes liability coverage, comprehensive coverage, and collision coverage, offering an extensive shield against almost all eventualities.

Unpacking the Key Coverages

- Liability Coverage: This is the foundation of full coverage. It pays for injuries and property damage to others as a result of car accidents where you’re at fault.

- Comprehensive Coverage: Think non-collision scenarios – natural disasters, theft, vandalism, or animal damage. If life throws you a curveball, comprehensive coverage could help you catch it.

- Collision Coverage: For those unfortunate times when you hit something, or something hits you, this coverage helps repair or replace your vehicle (minus your deductible).

Whether you own your vehicle outright or you’re still paying off a loan, the safety net of full coverage can provide not only fiscal protection but also a much-needed sense of security.

Understanding the Factors that Influence the Cost of Full-Coverage Car Insurance

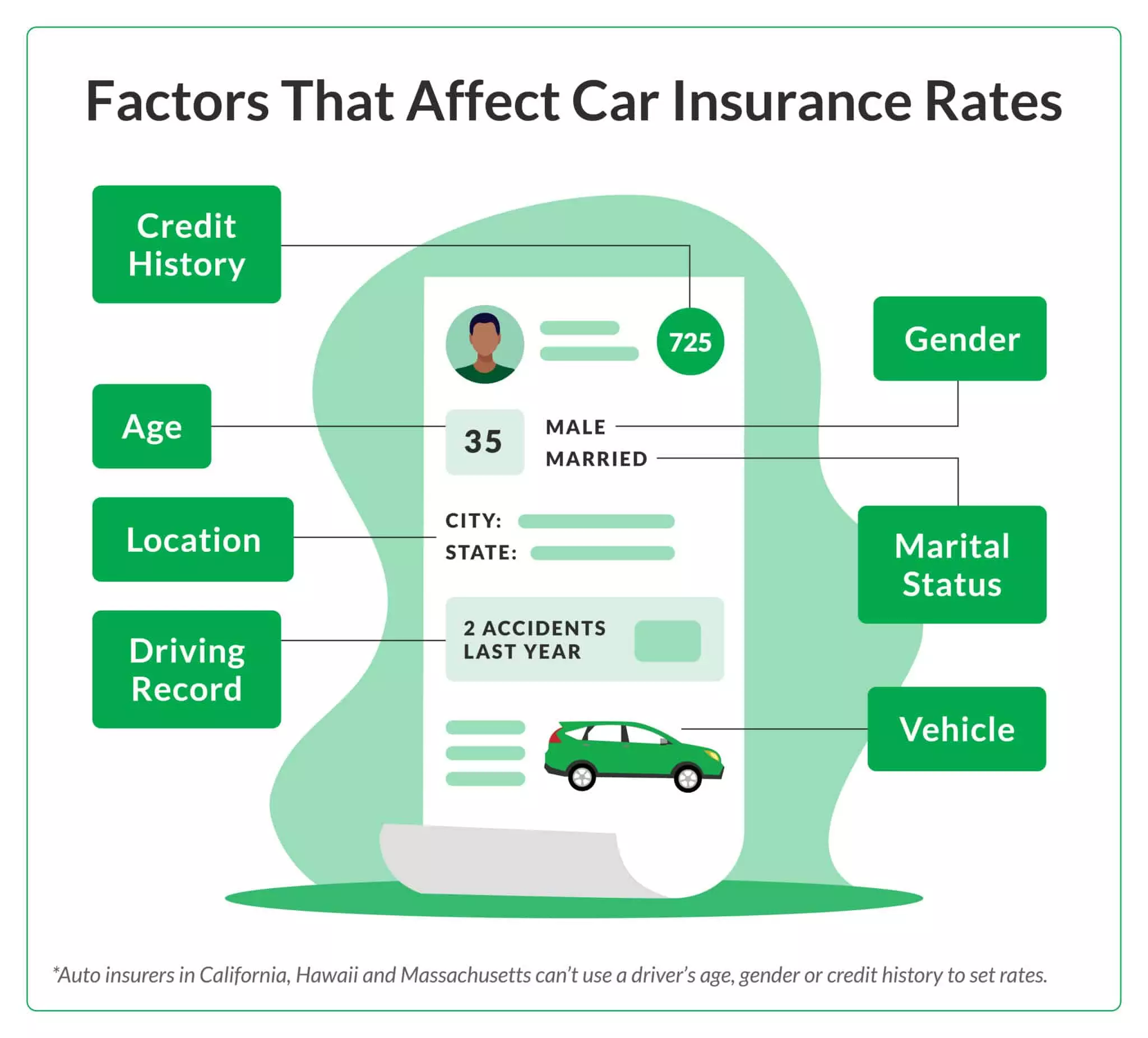

The costs of car insurance are not arbitrary; they’re meticulously calculated based on a broad range of variables. Companies utilize complex algorithms encompassing statistical data, historical trends, and personal details to arrive at your premium.

Personal Variables

- Driving Record: One’s history on the road is an influential factor. If you have a clean record, you’re likely to pay less. On the other hand, multiple violations could result in significantly higher premiums.

- Age and Gender: Statistics demonstrate that younger drivers and male drivers are involved in more accidents, thus they tend to pay more.

- Credit Score: Although somewhat contentious, many insurance providers use credit as a factor in determining risk. A lower credit score could lead to a higher premium.

Vehicle-Related Factors

- Year, Make, and Model: Newer, more expensive cars will result in higher premiums, as will high-performance models.

- Safety Features: Vehicles with advanced safety features such as anti-lock brakes, airbags, and anti-theft systems can often lead to lower premiums.

Location and Usage

- Location: The area in which you live, specifically its crime and accident rates, heavily influences your insurance costs. Urban environments typically come with higher premiums.

- Mileage: Similarly, how much and how frequently you drive can impact rates. Less time on the road generally means a lesser chance of an accident.

Other Variables

- Coverage Limits and Deductibles: Opting for higher coverage limits and lower deductibles will naturally drive up your costs.

- Other Drivers on Your Policy: Teenage drivers or those with poor driving records can spike your premium, as they are considered risks as well.

By understanding these underlying determinants, you gain a clearer insight into the pricing nuances of your car insurance and are better equipped to make informed decisions when shopping for coverage.

Navigating The Price Points

Now that you appreciate the various facets that can tweak your car insurance premium, it’s time to discuss actual costs. Data from various providers and industry reports unveil a broad spectrum of financial expectations.

The National Average

The national average cost for full coverage car insurance hovers around the $1,426 mark per year, but this is just a baseline figure. Individual rates can drastically differ based on the previously mentioned factors, as well as the specificities of the insurance company you choose.

Regional Variations

Regional disparities in average car insurance costs are not uncommon. For instance, urban areas might experience premiums significantly higher than their rural counterparts due to higher risks associated with congestion and vehicle-related crimes.

Age and Experience

It’s no secret that younger and less experienced drivers face notably higher premiums. On average, a 20-year-old pays $5,333 for their own policy – over $4,500 more than the national average. However, with each passing year and milestone, rates tend to drop, showing new drivers that patience is as much a virtue as good defensive driving skills.

Gender-Driven Costs

While the topic remains contentious, gender does play a role in the cost of car insurance. On average, young males pay about 16% more than females of the same age, a statistic rooted in historical risk profiles.

Reducing Your Full Coverage Premiums

Armed with the knowledge of what contributes to your premium, it’s time to put that knowledge into action and proactively seek ways to potentially curb your costs.

Defensive Driving Courses

Completing a defensive driving course not only sharpens your skills and reduces the chance of an accident, but it can also lead to an insurance discount.

Bundling Policies

Combining your car insurance with another type of policy, such as home or renters insurance, could lead to significant savings through a multi-policy discount.

Maintaining a Clean Record

Avoiding accidents and traffic violations not only keeps you safe but also maintains your eligibility for lower premiums.

Vehicle and Policy Adjustments

Consider adjusting your coverage amounts and deductibles based on your risk tolerance and financial capabilities. Consult with your insurance agent to find the most suitable balance for your needs.

Shop Around Regularly

Insurance rates are not static; they can and do change. Shopping around annually or semi-annually ensures you’re always getting the best deal.

Concluding Thoughts

While the cost of full coverage car insurance might seem like an undue burden, the financial and emotional protection it provides in the event of an accident is immeasurable. By approaching the purchase of car insurance with a strategic mindset, you can ensure that your investment is both protective and practical. Keep in mind that the cheapest policy might not always be the best, so weigh the costs against the benefits carefully.

Navigating the world of car insurance is much like driving; it requires attention, skill, and a degree of foresight. With the information presented in this blog article, you are now better equipped to explore the path to full coverage that best suits your needs and budget. Remember, your policy should fit you like a well-tailored suit – it should be customized, comfortable, and provide the right level of protection for your unique circumstances. Safe travels!