Insurance can be a complex world to enter, full of jargon and fine print. Whether you’re a first-time insurance buyer or a seasoned financial planner, the quest for the ideal policy at the best rate often begins with the comparison of insurance quotes. It’s a task that requires patience, a keen eye for detail, and the understanding that the cheapest option isn’t always the best. To help you make informed decisions when navigating the insurance market, this comprehensive guide will break down the intricacies of comparing insurance quotes, guiding you through the process step by step. By the end of this read, you’ll be equipped with the knowledge to drive a great bargain and, most importantly, to safeguard your financial well-being with a policy that truly suits your needs.

Section 1: Understanding the Quotes

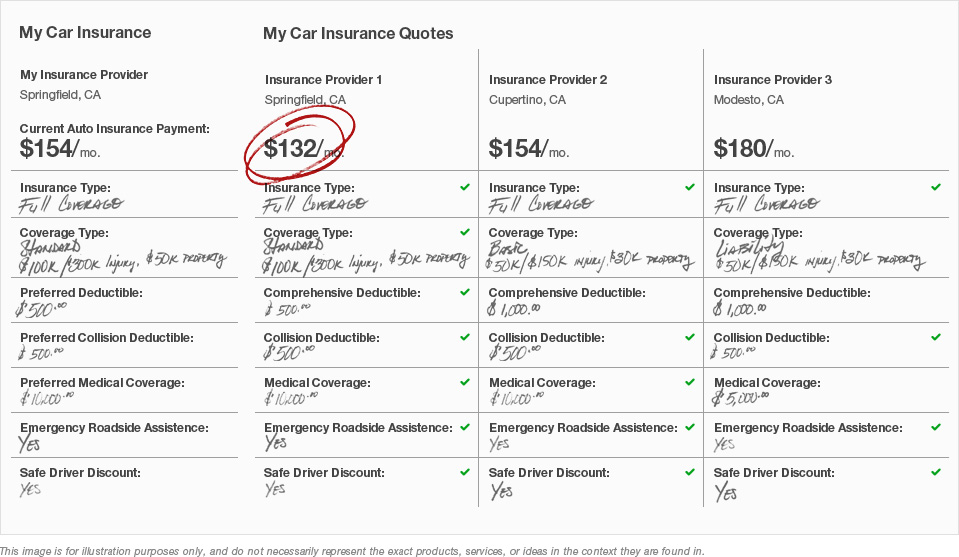

When you’re comparing insurance quotes, you’re essentially shopping for the best deal on financial protection. Each quote is an offer from an insurance provider, detailing the terms and pricing of the policy they’re willing to provide. Here’s what to look for:

Elements of a Quote

- Coverage Details: This outlines what you’ll be protected against and the limits of that protection.

- Premium: The price of the insurance policy, which can be paid monthly, quarterly, semiannually, or annually.

- Deductible: The amount you must pay out of pocket before your insurance kicks in.

- Exclusions: Any specific risk or condition not covered by the policy.

- Riders: Additional benefits or clauses that can be added to the policy for an extra cost.

Why Compare?

Not all insurance policies – or providers – are created equal. While it can be tempting to opt for the first quote you receive, comparing quotes ensures you’re getting the best value for your money. Different companies have various underwriting guidelines, which can lead to significant differences in the premiums they offer for similar coverage.

Section 2: Types of Insurance Quotes to Compare

The types of insurance you may need can be as varied as your life’s pursuits. When it comes to comparison, the process is generally the same, but key factors will differ:

Auto Insurance

For auto insurance, factors such as the type of vehicle, your driving history, and geographic location can heavily influence the quote. Discounts for bundling multiple policies, maintaining a good driving record, or setting up automatic payments can also vary among providers.

Home Insurance

For homeowner’s insurance, you’ll need to understand the replacement cost of your home and its contents, and be aware of any additional coverage needed for natural disasters or valuable items. Insurance implications related to home age, condition, and risk factors in your area also come into play.

Life Insurance

Life insurance is a fundamentally different product that necessitates comparing policy types (term, whole, universal) and understanding the benefits in addition to the premium, such as the cash value, payout structures, and living benefits.

Health Insurance

With health insurance, the complexity lies in the breadth of coverage. Besides premiums and deductibles, understanding co-pays, annual maximums, and networks is crucial. Those with pre-existing conditions should pay special attention to which conditions are covered, and at what cost.

Section 3: The Art of Reading Between the Lines

Insurance quotes may sometimes appear like apples-to-apples comparisons, but there’s usually a lot of fine print that can significantly affect their value. It’s important to:

Scrutinize Limits, Coverages, and Deductibles

- Ensure that the requirements and protections are what you need for your unique circumstances.

- A lower premium may come with higher deductibles or lower coverage limits – consider the implications of these trade-offs.

Understand Exclusions

- Exclusions are the ‘what ifs’ that the insurer won’t cover. They can include anything from certain types of damage to specific activities.

- Make sure you’re comfortable with these exclusions and that they make sense for your lifestyle or situation.

Beware of Overlapping or Missing Coverage

- When comparing, it’s not just about the price. Ensure you’re getting coverage for areas that matter to you.

- Equally, be wary of paying for coverage you don’t need – certain quotes may bundle in extras that are irrelevant to your situation.

Section 4: Tactics for Effective Comparison

The key to a successful insurance quote comparison is to be thorough and strategic. Here are some proven tactics to get the most out of the process:

Online Tools and Calculators

Several online tools make it easy to compare insurance quotes from multiple carriers at once. These can save you significant time and give you a general idea of the market.

Speak Directly with Agents

While technology can streamline the process, it may not capture all possible discounts or nuances of your personal situation. Speaking directly with an agent can often reveal additional savings or tailored policies.

Have Your Information Ready

Ensure you’re providing consistent and complete details to each insurer you approach. Your driving record, home ownership history, medical background, and any existing policies or claims can all impact your quotes.

Ask the Right Questions

Don’t be afraid to ask for clarifications and inquire about aspects of the policy or quote that may be unclear. The better you understand the policy, the more confident you can be in your decision.

Consider the Company’s Reputation

The financial stability of the insurer and their customer service track record are key considerations. A lower quote from an unknown company may not be worth it if they have a poor claims process or are financially unstable.

Section 5: Making the Decision

After all that comparison, it’s time to make a decision. But with several quotes in hand, which do you choose? Consider the following:

Which Policy Best Meets Your Needs?

It’s not just about the price. Your chosen policy must provide the type and level of coverage that you deem necessary.

The Total Cost of Ownership

Considering the premium, deductible, and the level of coverage, ask yourself which policy will be the most affordable in the long-term considering all potential scenarios.

Additional Perks or Benefits

Sometimes a slightly higher premium can be justified by the wealth of additional benefits on offer. These could range from responsive customer service to quicker claim processes or rewards programs.

Finalizing the Process

Once you’ve decided, it’s time to take action. Contact your chosen insurer to finalize the details and get your new policy in place. Be sure to double-check all the information before signing to avoid issues down the line.

Conclusion

Insurance is your safety net in an unpredictable world. By learning the art of comparing insurance quotes, you gain the power to secure not just any policy, but the quintessential one tailored to your needs. Don’t be intimidated by the task – approach it thoughtfully and with diligence. Invest the time to gather and understand quotes, use comparisons to your advantage, and remember that what you’re really buying is peace of mind. Stay informed, be thorough, and always take the time to ensure you’re getting the best coverage and deal possible. Your future self will thank you for it.